Title Loans Boise ID

Title Loans are an excellent option for those who need fast cash. There are several benefits to this type of loan, including the fact that borrowers don’t need good credit and can receive funds immediately without having to submit collateral. The loan is unsecured, which means that there are no strict terms and conditions. In addition, borrowers can get their cash in less than one day. However, this option can be risky for people who don’t have a good credit history, or who don’t have a car that can be easily refinanced.

Another benefit is that Title Loans in Boise Idaho can be paid with many forms of payment. Some stores only accept cash, while others accept cashier’s checks, money orders, and debit cards. This means that you won’t have to travel to a physical store to pay for the loan. Some companies will take information over the phone as well, but you should know that you’ll probably have to pay a processing fee if you use a debit card.

Car Title Loans Boise ID

Another benefit is that title loans in Boise Idaho don’t require a perfect credit score. Instead, they focus on the value of the vehicle and not your employment status. The entire process can be done in under an hour. Most title loan companies in Boise also offer same-day cash, which is a great feature when you need emergency cash. If you’re in need of emergency cash, consider applying for a title loan in Boise. The benefits are worth the risk.

The biggest benefit of title loans in Boise Idaho is that they don’t require collateral. Because of the low interest rate, borrowers can borrow up to $25,000 with the title of their vehicle. They can also offer flexible monthly payments and competitive interest rates. This is one of the most attractive features of title loans in Boise. If you’re struggling to meet your financial obligations, you’ll need to consider getting a title loan in Boise.

Car Equity Loans Boise ID

Another benefit of title loans in Boise Idaho is that you don’t have to pay interest only if you’re paying your loan back in 30 minutes or less. With an average annual interest rate of 1.20%, Idaho car title loans are a great choice for people with bad credit or need quick cash. There are many advantages to getting a title loan in Boise. Once you have an established monthly income, you can afford to borrow up to $500 a month.

As mentioned before, Idaho car title loans are an excellent option for people with bad credit. These loans can be used for emergency situations such as unexpected bills, maintenance costs, and more. You can get up to $750 from these lenders in just one day. You can also use them to pay for college expenses, such as textbooks. Depending on your situation, the money you receive can be as much as $1,000.

Title Pawn Boise ID

The rates charged by American title loans in Idaho can be high compared to those of Idaho. The interest rate is higher in these states, so it’s worth contacting the lending company in your area to get more information. You can also apply for the loan in person, although many of them don’t advertise their fees and terms online. The process of obtaining a title loan in Boise is simple. When you’re ready to obtain the loan, simply visit the closest location.

The loan is unsecured, so you’re not putting up collateral. You can borrow a lot more money than you would with a payday installment loan. A car title loan Idaho is a good option for people who have bad credit or are looking to improve their credit. The benefits of Title Loans in Boise, Idaho are worth considering. So, go ahead and take advantage of these loans today.

There are many benefits to title loans in Boise, Idaho. The first is that it allows you to use your vehicle as collateral. This makes title loans an excellent option for people with bad credit. As collateral, your title is used as a loan, so your lender must have a clear copy of it. It is important to understand how a title loan works before applying for one. It is important to understand the terms and conditions of a loan, and the lender’s policies and repayment plans.

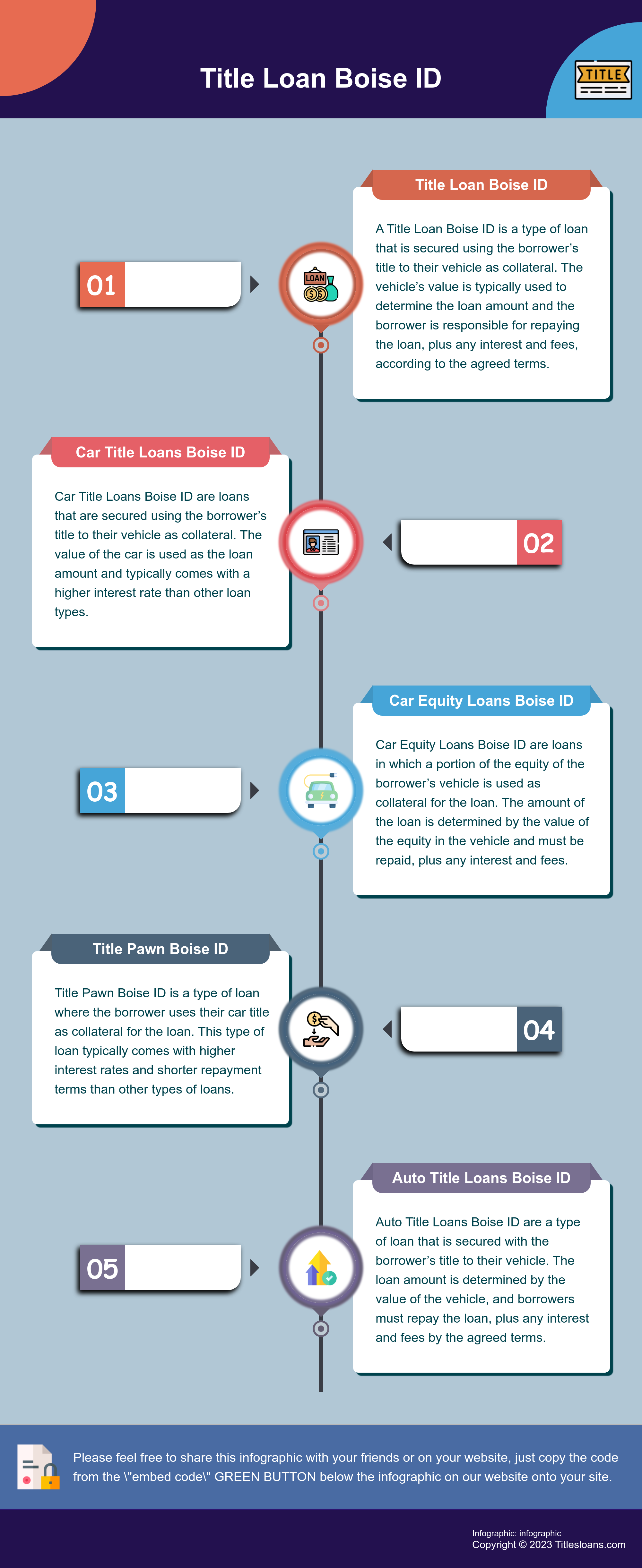

Title Loan Boise ID

A Title Loan Boise ID is a type of loan that is secured using the borrower’s title to their vehicle as collateral. The vehicle’s value is typically used to determine the loan amount and the borrower is responsible for repaying the loan, plus any interest and fees, according to the agreed terms.

Car Title Loans Boise ID

Car Title Loans Boise ID are loans that are secured using the borrower’s title to their vehicle as collateral. The value of the car is used as the loan amount and typically comes with a higher interest rate than other loan types.

Car Equity Loans Boise ID

Car Equity Loans Boise ID are loans in which a portion of the equity of the borrower’s vehicle is used as collateral for the loan. The amount of the loan is determined by the value of the equity in the vehicle and must be repaid, plus any interest and fees.

Title Pawn Boise ID

Title Pawn Boise ID is a type of loan where the borrower uses their car title as collateral for the loan. This type of loan typically comes with higher interest rates and shorter repayment terms than other types of loans.

Auto Title Loans Boise ID

Auto Title Loans Boise ID are a type of loan that is secured with the borrower’s title to their vehicle. The loan amount is determined by the value of the vehicle, and borrowers must repay the loan, plus any interest and fees by the agreed terms.